Planning for Death – Getting Your Affairs in Order | Episode 361

Podcast: Play in new window | Download

Subscribe: RSS

Planning for Death – Getting Your Affairs in Order | Episode 361

Death is a difficult topic, but avoiding the conversation can leave your loved ones dealing with unnecessary stress and legal battles. In this episode of the Survivalpunk Podcast, we discuss the importance of getting your affairs in order, lessons learned from personal experience, and how to encourage family members to plan ahead.

Why Planning for Death Matters

Too often, people pass away without a will, leaving their assets in limbo and their loved ones scrambling to handle legal and financial matters. If you don’t have a plan, the state will decide how your assets are distributed, which can be costly, time-consuming, and lead to conflicts among family members.

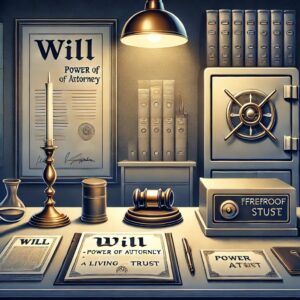

The Essential Documents Everyone Should Have

To ensure a smooth transition for your loved ones, here are the most important documents you should have in place:

1. A Will

A legally binding will ensures that your assets go to the people you want them to. Without one, your estate could be tied up in probate, and the state may decide who gets what.

2. Power of Attorney (POA)

A POA allows a trusted person to make legal or financial decisions on your behalf if you become incapacitated.

3. Living Will & Healthcare Proxy

These documents outline your medical wishes if you’re unable to communicate them yourself and designate someone to make medical decisions for you.

4. Beneficiary Designations

Many assets, like life insurance policies and retirement accounts, pass directly to beneficiaries named on the account. Ensure these are up to date.

5. A Digital Legacy Plan

With so much of our lives online, it’s crucial to consider what happens to social media, email accounts, and digital assets after death.

Avoiding Probate and Estate Planning Basics

- Consider a Trust – A revocable living trust can help avoid probate and provide a smoother transition of assets.

- Joint Ownership & Transfer-on-Death Designations – These options can make asset transfers much simpler and avoid lengthy legal proceedings.

- Keeping Records Accessible – Store documents in a secure, fireproof safe and ensure your executor or a trusted individual knows where to find them.

Talking to Family About Death Planning

Bringing up the subject of wills and estate planning can be awkward, but it’s necessary. Here are a few tips to make it easier:

- Start with your own plans – Share what you’ve done and why it’s important.

- Use real-life examples – Talk about situations where a lack of planning caused issues.

- Encourage small steps – Suggest starting with basic documents like a will and beneficiary updates.

Final Thoughts

No one likes to think about their own mortality, but proper planning can save your family from unnecessary hardship. Take the time to get your affairs in order and encourage your loved ones to do the same.

Tune in to this episode as we break down everything you need to know about planning for death, ensuring a smooth process for your family, and securing your legacy.

Want to discuss this episode? Join the Survivalpunk community and share your thoughts!

Links

SentrySafe Fireproof Money Safe with Key Lock

Think this post was worth 20 cents? Consider joiningThe Survivalpunk Army and get access to exclusivecontent and discounts! |

Don’t forget to join in on the road to 1k! Help James Survivalpunk Beat Couch Potato Mike to 1k subscribers on Youtube

Want To help make sure there is a podcast Each and every week? Join us on Patreon

Subscribe to the Survival Punk Survival Podcast. The most electrifying podcast on survival entertainment.

Like this post? Consider signing up for my email list here > Subscribe

Join Our Exciting Facebook Group and get involved Survival Punk Punk’s

Follow Us!